When you slice up your payments with Klarna, you will know exactly how much you pay each month and in total. Client Token, A token identifying an order session. Even with inflation easing, more shoppers are relying on buy now, pay later programs to afford household essentials.

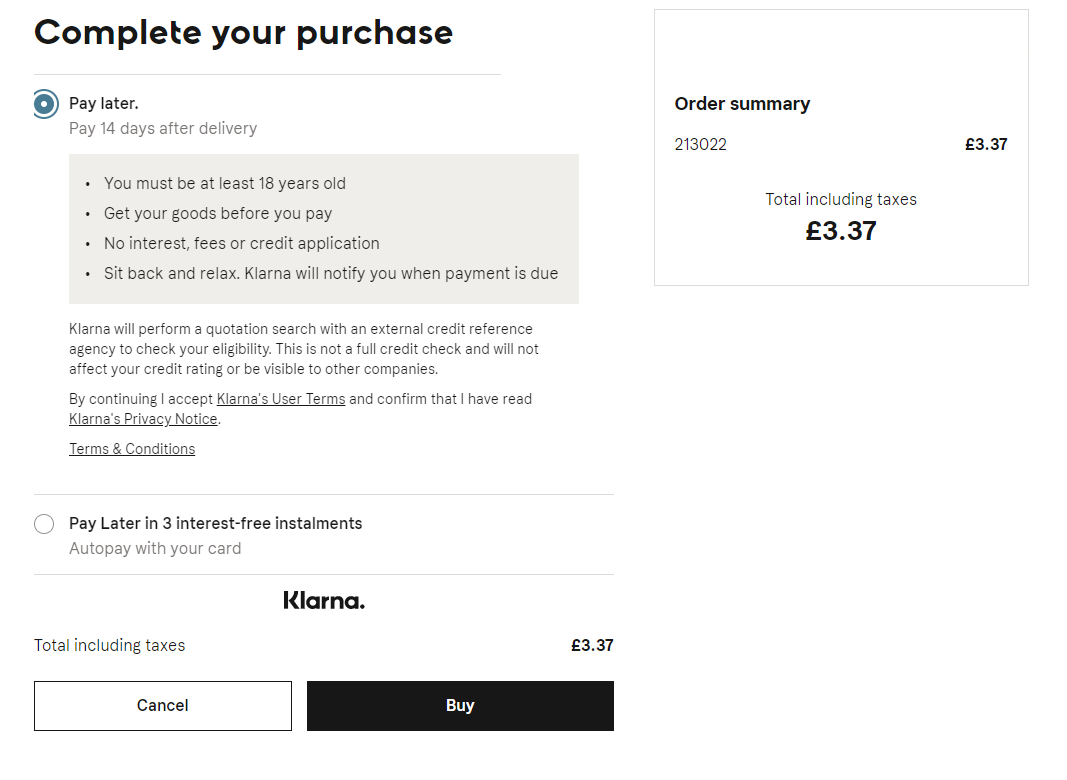

Klarna is in over 70,000 online stores and has more than 60 million users globally. KP renders categories of payment methods, like Slice It, Pay Now and Pay Later. Klarna is a global payment solutions company that works with merchants to provide their customers the smoothest online shopping experience. Klarna WANT SOME NEW HAIR 'n HEELS BUT RUNNING LOW ON FUNDS THIS MONTH PAY LATER IN 3 EASY INSTALMENTS WITH KLARNA. Klarna covers all the fraud and financial risks that may arise when offering your customers the option to pay using Slice it.įor more information on the costs, check out ‘What are the costs for using Klarna?’ in our Help Center.We have partnered with Klarna to provide you with flexible financing on purchases, so you can ease the costs and pay over time. Klarna: Slice it is available for customers in: Germany, Austria, Finland, Sweden, Norway. Klarna covers all fraud and financial risks that arise when offering your customers the option to pay over time.Īs a consumer-centric company, Klarna bases variables like costs and the availability of their products on your customer’s location. For more information on the costs and availability, check out the Help centre. For effortless recurring payments, customers can also choose to link a bank account to their Klarna account.Īs a consumer centric company, Klarna bases variables like costs and the availability of their products on the location of your customer. Customers pay the amount due in installments over 6 to 36 months, with or. There are three different payment options you can integrate using a payment page builderPay Later, Pay Now, and Slice It. With Klarna Slice It, you can offer your customers the ability to pay with financing. The actual payments take place at a later moment and are made in the Klarna app or customer portal through another payment method like iDEAL or credit card. One of the biggest draws to Klarna is how many choices it offers to customers regarding payment. The credit check, that runs in the background while your customer is paying, will assess whether the customer is eligible for consumer financing and what the available monthly installments are.

#Klarna slice it payments install

Install now Flexible payments anywhere with the Klarna app. Manage all your payments in the Klarna app.

It's our new extension so you can split your purchase, directly from your desktop.

No matter which duration your customer chooses, as a merchant you will get paid out 5 business days after an order is shipped. The Klarna app just got a new best friend, Klarna for Chrome. Offering an easy way of consumer financing is especially a great advantage when you have a high average order value, lowering the barrier for customers to make the purchase.īy filling out a few simple personal details, customers can cut up the amount due in installments and pay it off in anywhere between 3 to 36 months, with interest or without. With Klarna: Slice it you can offer your customers to pay with consumer financing, without them having to go through a lengthy sign up process.

0 kommentar(er)

0 kommentar(er)